How The Affluent Approach Retirement

Retirement is more than the conclusion of a rewarding career—it’s the beginning of a new exciting life chapter. For affluent retirees, this much awaited life transition is preceded by careful planning and thoughtful execution. Their approach goes beyond saving for retirement, it’s about creating a lifestyle to balance financial security, personal fulfillment, and leaving a legacy.So, just how do affluent retirees prepare for retirement? Let’s explore some key strategies.

1. Start Planning Early

Affluent individuals often begin retirement planning decades ahead of anticipated retirement and often includes:

- Maximizing retirement accounts like 401(k)s, IRAs, and Roth IRAs

- Investing in diversified portfolios that include stocks, bonds and ETFs

- Working with financial advisors to create long-term wealth strategies

Early planning also allows for the advantage of compound interest and market growth over time.

2. Prioritize Tax Efficiency

Wealthy retirees understand that it’s not just what you earn—it’s what you keep.

- Use tax-advantaged accounts and strategic withdrawals to minimize tax burdens

- Consider relocating to tax-friendly states or countries

- Employ trusts and charitable giving to reduce estate taxes and support causes they care about

3. Design a Purposeful Lifestyle

Affluent retirees don’t just stop working—they transition into a new phase of life with intention. This might include:

- Pursuing passion projects or starting a business

- Volunteering or mentoring in their communities

- Traveling extensively or maintaining multiple residences

- They often view retirement as a time to explore, grow, and give back

4. Plan for Longevity and Healthcare

With longer life expectancies, affluent retirees prepare for the long haul by carefully considering their long-term care (LTC) options. They understand that healthcare needs evolve with age, and having a plan in place helps ensure both quality of care and peace of mind. Common LTC options include:

- Home Care Services – Ideal for those who prefer to age in place, this includes in-home aides, skilled nursing, and therapy services.

- Assisted Living Facilities – These communities offer housing, meals, and help with daily activities like bathing and medication management, while still promoting independence.

- Memory Care Units – Specialized facilities designed for individuals with Alzheimer’s or other forms of dementia, offering structured routines and secure environments.

- Skilled Nursing Facilities (SNFs) – Provide 24/7 medical care and rehabilitation services for those recovering from surgery or managing chronic conditions.

- Continuing Care Retirement Communities (CCRCs) – Offer a full spectrum of care—from independent living to skilled nursing—allowing residents to transition as their needs change.

- Hospice and Palliative Care – Focused on comfort and quality of life for those with serious or terminal illnesses, often provided at home or in specialized centers.

To help cover these potential care costs, affluent retirees often purchase long-term care insurance, choosing from several policy types:

- Traditional LTC Insurance – Offers a set daily or monthly benefit for a specific number of years. These policies typically reimburse actual care expenses and may include inflation protection.

- Hybrid Life Insurance with LTC Riders – Combines life insurance with long-term care coverage. If LTC benefits are not used, the policy pays a death benefit to beneficiaries.

- State Partnership Policies – Designed to work with Medicaid, these allow policyholders to protect a portion of their assets if they eventually need to apply for Medicaid coverage.

- Annuity-Based LTC Policies – Use a lump-sum premium to fund an annuity that provides long-term care benefits, often with tax advantages.

Hybrid LTC policies are especially popular among affluent retirees. These combine permanent life insurance with LTC coverage, allowing access to the death benefit for care expenses. If LTC benefits are unused, the beneficiaries receive the death benefit amount. Hybrid options offer premium stability, estate planning advantages, and eliminate the 'use-it-or-lose-it' risk of traditional policies.

5. Focus on Legacy and Estate Planning

Leaving a legacy is a major priority for affluent retirees and they take a proactive approach to ensure their accumulated wealth is preserved and passed on according to their wishes.

Key strategies include:

- Creating comprehensive estate plans that include wills, powers of attorney, and trust accounts—such as revocable living trusts, irrevocable trusts, and special needs trusts—to manage and distribute assets efficiently while potentially avoiding probate.

- Using trusts to provide privacy, protect beneficiaries, and reduce estate taxes. For example, special needs trusts are designed to provide for loved ones with disabilities without jeopardizing their eligibility for government benefits like Medicaid or Supplemental Security Income (SSI).

- Involving family in financial discussions to ensure transparency and smooth wealth transfer.

- Supporting philanthropic causes through private foundations or donor-advised funds, aligning their legacy with their values.

By incorporating trust structures—including those tailored for unique family needs—affluent retirees gain greater control over how their assets are managed and distributed, both during their lifetime and after.

6. Stay Financially Engaged

Even in retirement, affluent individuals often:

- Monitor their investments and adjust as needed

- Stay informed about market trends and economic shifts

- Continue working with advisors to refine their financial plans

7. Rely on Professional Advisors

Affluent retirees rarely go it alone, understanding how expert guidance can help make a significant difference in both wealth preservation and lifestyle planning. Their advisory team often includes:

- Financial Advisors – to manage investments, optimize income streams, minimize investment costs and help ensure long-term financial health.

- Tax Professionals – to develop tax-efficient strategies and stay compliant with changing laws.

- Estate Attorneys – to create wills, trusts, and other legal structures that protect assets and help ensure smooth wealth transfer.

- Healthcare Consultants – to help navigate Medicare, long-term care options, and insurance planning.

By working with a team of trusted professionals, affluent retirees may gain peace of mind and the freedom to focus on enjoying their retirement years.

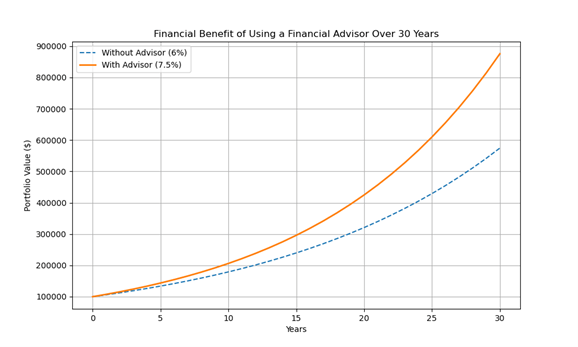

Figure: Financial Benefit of Using a Financial Advisor Over 30 Years

8. Maintain a Dedicated Emergency Fund

Even with substantial wealth, affluent retirees understand the value of liquidity and preparedness. An emergency fund acts as a financial safety net, helping to ensure that unexpected expenses do not disrupt their long-term plans.

The emergency fund is typically:

- Easily accessible, often kept in high-yield savings or money market accounts.

- Sized appropriately, covering at least 6–12 months of living expenses or more, depending on lifestyle and risk tolerance.

- Separate from investment accounts, so market fluctuations don’t affect its availability.

Whether it’s for unexpected medical costs, family emergencies, or economic downturns, having a well-funded emergency reserve helps provide peace of mind and financial flexibility.

9. Understand Their Social Security Benefits Before Claiming

Affluent retirees know that when and how they claim Social Security (SSA) may significantly impact their total lifetime benefits. Rather than rushing into triggering Social Security, they consider the following:

- Review earnings history to ensure accuracy and maximize their benefit amount.

- Strategize the timing of one’s Social Security claim—waiting until full retirement age or even age 70 may result in significantly higher monthly payments.

- Coordinate with other income sources, such as pensions, investments, or spousal benefits, to create a tax-efficient and sustainable income plan.

- Consult with financial advisors to model different claiming scenarios and choose the one that best supports long-term goals.

By understanding the nuances of SSA benefits, affluent retirees are prepared to make more informed decisions, helping to enhance their financial security and flexibility.

Final Thoughts

Affluent retirees approach retirement not as an end, but as a new beginning—one that’s carefully crafted through years of planning, smart financial decisions, and a clear vision for the future. Whether you're just starting your retirement journey or refining your plan, there’s a lot to learn from their approach.

Your next step in becoming an Affluent Retiree

ClearPlan Wealth Management (CPWM) is a full-service financial services company based in Hunt Valley, Maryland. Serving affluent clients for more than 25 years, our process-based approach to wealth management encompasses proactive guidance for all client financial matters. Affiliated with Raymond James Financial Services, CPWM offers you all the capabilities of a Fortune 500 company, delivered through the personal relationships of each member of our team. In our drive to be known as a “connector of professionals”, CPWM strives to exceed your expectations by providing a stellar, all-encompassing client experience - from seasoned business entrepreneurs to new investors.

Every investor’s situation is unique, and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation. You should discuss any tax or legal matters with the appropriate professional. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Troy D. Brewer, and not necessarily those of Raymond James. Written with the assistance of Microsoft CoPilot.