Diversifying for the Future: A Strategic Approach to Fixed Income, Large Company Equity, AI, Nuclear Power, and Global Markets

In an increasingly complex and interconnected financial world, diversification remains one of the most powerful tools for managing risk and enhancing long-term returns. While traditional portfolios often lean heavily on domestic equities and bonds, today’s savvy investors are looking beyond borders and into the future—balancing stability with innovation. In this post, we explore a modern diversification strategy that emphasizes fixed income, core large US company holdings, AI technology investments, nuclear energy and developed markets outside the U.S.

The following overview is one opinion and designed for an investor that has a moderately aggressive risk tolerance. Investment changes should be reviewed and evaluated with your financial advisor.

1. The Foundation: Fixed Income for Stability

Fixed income investments—such as government and corporate bonds, municipal debt, and structured products—form the bedrock of a well-diversified portfolio. In 2025, with interest rates stabilizing after a period of volatility, fixed income is regaining its appeal for several reasons:

- Predictable Cash Flow: Bonds provide regular interest payments, ideal for income-focused investors.

- Capital Preservation: High-quality bonds can help protect principal during equity market downturns.

- Diversification Benefits: Fixed income often behaves differently than stocks, reducing overall portfolio volatility.

Key Opportunities:

- Investment-grade corporate bonds with strong balance sheets.

- Municipal bonds offering tax advantages.

- Short-duration bonds to reduce interest rate sensitivity.

2. The Growth Engine: AI Technology Investments

Artificial Intelligence is not just a buzzword—it's a transformative force reshaping industries from healthcare to finance. Investing in AI offers exposure to one of the most dynamic growth areas of the 21st century.

Why AI?

- Exponential Innovation: AI is driving breakthroughs in automation, data analysis, and decision-making.

- Cross-Sector Impact: From autonomous vehicles to personalized medicine, AI is everywhere.

- Strong Earnings Potential: Leading AI firms are showing robust revenue growth and expanding margins.

How to Invest:

- AI-focused ETFs that provide diversified exposure to top AI innovators.

- Individual stocks in companies leading in machine learning, cloud computing, and semiconductor design.

- Venture capital or private equity for accredited investors seeking early-stage opportunities.

3. The Core: US-Based Large Cap Core Investments

US-based large cap core investments, both value and growth, provide a solid foundation for any diversified portfolio. These investments offer stability, liquidity, and potential for growth.

Why US-Based Large Cap Core?

- Market Leaders: Large cap companies are often industry leaders with strong competitive advantages.

- Stability: These companies tend to have more stable earnings and lower volatility compared to smaller companies.

- Growth Potential: Many large cap companies continue to grow and innovate, providing opportunities for capital appreciation.

How to Invest:

- Large cap core mutual funds or ETFs that provide broad exposure to US large cap stocks.

- Individual stocks of well-established companies with strong fundamentals.

4. The Global Edge: Developed Markets Beyond the U.S.

While the U.S. remains a powerhouse, developed markets abroad offer compelling diversification benefits and attractive valuations.

Why Look Abroad?

- Valuation Gaps: European and Asian developed markets often trade at lower P/E ratios than U.S. counterparts.

- Currency Diversification: Exposure to foreign currencies can hedge against dollar depreciation.

- Sectoral Differences: International markets may be more heavily weighted in sectors like industrials, materials, or financials.

Top Picks:

- Europe: Germany, France, and the Nordics for industrial and green tech innovation.

- Asia-Pacific: Japan and South Korea for advanced manufacturing and robotics.

- Global ETFs: Funds that track developed markets ex-USA (e.g., MSCI EAFE Index).

5. The Future of Energy: Investing in Nuclear Power

Investing in nuclear power offers several compelling benefits, especially in the context of long-term energy needs, sustainability, and diversification.

Benefits of Investing in Nuclear Power:

- Reliable and Consistent Energy Source: Nuclear plants provide a steady output of electricity, unlike solar or wind which are intermittent.

- Low Carbon Emissions: Nuclear energy produces virtually no greenhouse gas emissions during operation.

- Long-Term Cost Efficiency: Once built, nuclear plants have low and predictable operating costs.

- Technological Innovation: Small Modular Reactors (SMRs) and advanced reactor designs promise safer, more flexible, and cost-effective solutions.

- Strategic and Geopolitical Value: Reduces reliance on imported fossil fuels and supports energy security.

- Investment Diversification: Nuclear investments may behave differently from traditional energy or tech stocks.

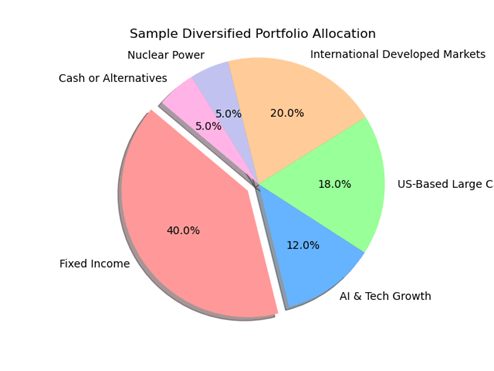

6. Putting It All Together: A Sample Allocation

Here is a hypothetical diversified portfolio for a moderate-risk investor:

- 40% Fixed Income (mix of U.S. Treasuries, corporate, and municipal bonds)

- 12% AI & Tech Growth (AI-focused ETFs and select tech stocks)

- 18% US-Based Large Cap Core (value and growth).

- 20% International Developed Markets (broad ETFs and regional funds)

- 5% Nuclear Power

- 5% Cash or Alternatives (for liquidity and tactical opportunities)

Sample Portfolio Allocation Pie Chart

7. Final Thoughts

Diversification is not just about spreading your money—it's about strategically allocating capital to balance risk and reward. By combining the stability of fixed income, the growth potential of AI, the core strength of US large cap investments, the global perspective of ex-USA developed markets, and the future promise of nuclear power, investors can build resilient portfolios ready for the challenges and opportunities of the future.

Every investor’s situation is unique, and you should consider your investment goals, risk tolerance and time horizon before making any investment. Investing involves risk and you may incur a profit or loss regardless of strategy selected. The forgoing is not a recommendation to buy or sell any individual security or any combination of securities. Be sure to contact a qualified professional regarding your particular situation before making any investment or withdrawal decision.