Current Market Movements and Market Volatility

I know many are concerned about the recent volatility we have been experiencing in the markets and are looking for direction. With over 30 years’ experience, I feel I have good insight on how to work through market volatility and maintain an outlook of long-term wealth accumulation. Here are a few items to keep in mind:

- Listening to market updates 24/7 will not only drive you crazy but will often push you to make unreasonable changes.

- Having a well-constructed investment plan in place will help keep your goals in focus and keep your actions aligned with the long term.

- A portfolio that is cost-efficient, diversified and formally reviewed is a good foundation for performance. Please know that my team and I are involved behind the scenes reviewing plans and portfolios.

- Quality investments that have proven earnings are preferred over more speculative (unproven) investments. Speculative investments (if wanted) should only represent a small part of any portfolio.

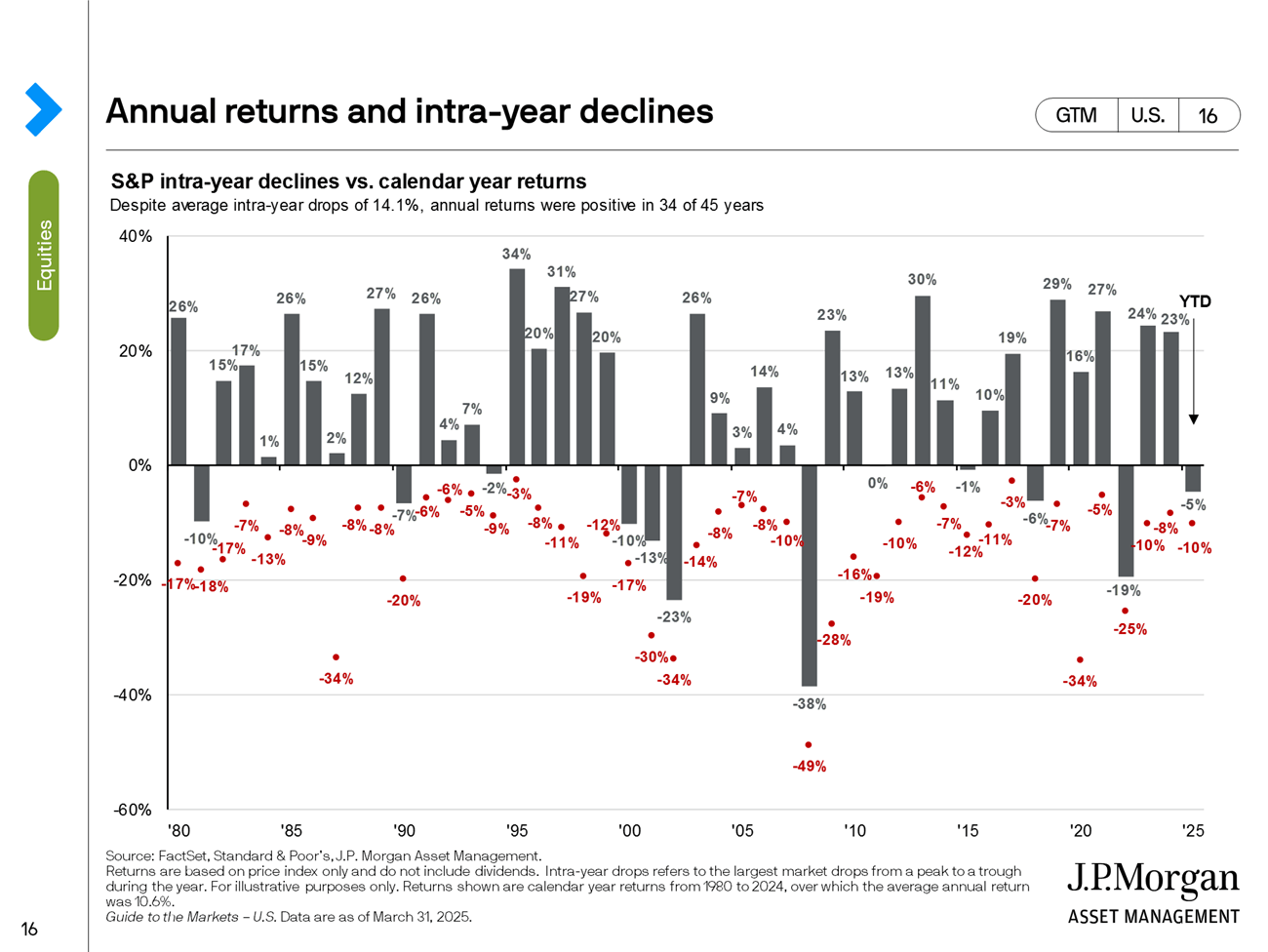

Our friends at JP Morgan publish one of my favorite charts that gives me calm and serves a good reminder of the relationship between volatility and long-term performance. Volatility is normal, common, and healthy for established markets. Volatility is a result of the markets digesting and adjusting to news / financial events. Long-term performance is what you get when you tune out the volatility, focus on goals, use high quality investments, and rebalance when appropriate. Volatility and market performance may work side by side and does not necessarily mean that one negatively effects the other. It is the investor who allows volatility to affect their actions and falls short of market performance.

The attached chart is an example of how volatility and market performance co-exist in the marketplace. Here are some key take-aways:

- Over the last 45 years, the performance of the S&P 500 has ended the year positive 34 times.

- As notated in red, every year, the markets have had “Intra” year pullbacks. These pullbacks have averaged a negative 14.1% per year over the 45-year period. There is little correlation between the market pullbacks and the total year performance.

- Even with the inter-year pullbacks, the S&P500 has averaged an annual return of 10.6% per year.

Conclusion:

Investors that stayed invested and paid little attention to volatility, over the long term, realized (attractive) positive market returns. It is reasonable to believe that the same may be true for the future.

About the Author:

Troy Brewer has a talent for connecting successful people while serving as a respected mentor on the path to prosperity. By facilitating an all-encompassing approach to wealth management, Troy utilizes his extensive network of resources including investment bankers, estate planners, accountants, and business leaders to develop creative financial solutions for his clients. By fostering meaningful relationships, orchestrating financial strategies, and serving as a trusted confidant, Troy helps his clients achieve their desired life and legacy.

Troy has spent more than 25 years in the financial services industry, focusing on maintaining tight multigenerational relationships through a process-driven approach. As a Chartered Retirement Plans Specialist® and member of the Baltimore Estate Planning Council, Troy specializes in low-cost investments, complex / multigenerational wealth planning and tax efficiency. His clients include business owners, corporate executives, and affluent families. Learn more about Troy or schedule a consultation.

The S&P 500 is an unmanaged index of widely held stocks that is generally considered representative of the U.S. stock market.

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Investor’s results will vary.

Every investor’s situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including a long term holding period, rebalancing, dollar cost averaging, diversification, and asset allocation.